Japan’s tennis equipment market is on an upward trajectory, with forecasts suggesting a market value of US$ 216.5 million in 2023, projected to climb to US$ 274.7 million by 2033. This growth is propelled by a blend of emerging trends, technological advancements, and competitive forces within the sector.

Key Trends Fueling Growth

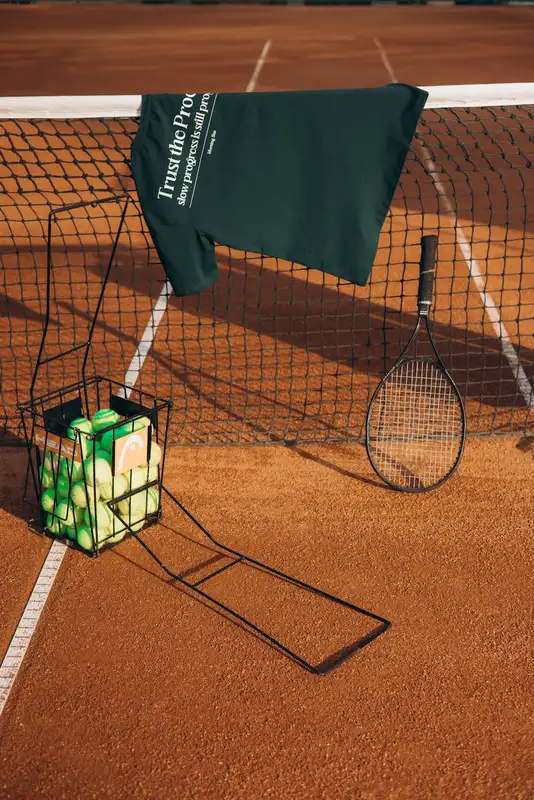

The increasing number of tennis enthusiasts in Japan has spurred demand for equipment such as racquets, balls, apparel, and footwear. The digital transformation of tennis, featuring smart equipment like sensor-equipped racquets and wearable technology, is drawing in tech-savvy players. Moreover, the shift towards eco-friendly products is gaining momentum, with consumers favoring equipment crafted from sustainable materials.

The rise of tennis tourism, amplified by events like the Tokyo Olympics, has further elevated the sport’s popularity, driving sales as tourists seek high-quality gear for their activities.

Industry Insights

Japan’s market exhibits a strong inclination towards premium tennis gear, with consumers ready to invest in top-tier racquets and clothing. The growth of online retailing has also been pivotal, providing consumers with a vast array of products and competitive pricing. Partnerships between Japanese tennis players and global brands are boosting the visibility of tennis equipment.

Comparative Industry Analysis

Japan distinguishes itself in Asia’s tennis equipment industry with a mature market that prioritizes quality. While China is experiencing rapid growth due to its large population, Japan focuses on premium products. South Korea’s market is expanding but remains smaller, and Australia’s market mirrors Japan’s in consumer preferences, though it has a stronger production presence.

Competitive Landscape and Innovations

The Japanese tennis equipment market is highly competitive, featuring both domestic and international brands such as Yonex, Mizuno, HEAD, Wilson, and Babolat. These companies are actively engaged in product innovation and collaborations with Japanese athletes.

Recent developments include the incorporation of technology into tennis equipment and sustainability efforts emphasizing eco-friendly materials. Japan’s role as a host for major international tournaments is anticipated to further invigorate the market.

Conclusion

Japan’s tennis equipment industry is set for remarkable growth, driven by an increasing demand for high-quality gear and a growing base of tennis enthusiasts. This presents promising opportunities for both local and international players in the market.